In late 2021, non-fungible tokens (NFTs) were everywhere. NFT discourse dominated online conversations, Bored Ape Yacht Club NFTs were discussed by celebrities on major talk shows and artists like Damien Hirst were looking at how they could get involved with this ‘supposedly revolutionary million-dollar asset’.

However, fast forward 24 months and everything has changed. In fact, a recent report has suggested that ‘the vast majority of NFTs are now worthless’. So, how did we get here?

What are NFTs?

Let’s start with a basic recap before we get into the nitty-gritty. NFT stands for non-fungible token.

An NFT is a form of crypto asset that is used to certify ownership and authenticity of a digital file, such as an image, a video or a piece of text.

The NFT boom

NFTs first hit mainstream headlines in March 2021, when crypto entrepreneur Sina Estavi paid $2.9m for an NFT of the first tweet from the former Twitter boss Jack Dorsey.

By the close of 2021, NFTs had become so popular that Melania Trump (yes, the former First Lady) had launched her own NFT collection named ‘Melania’s Vision’. During the year, we’d also witnessed a number of eye-catching sales. A single NFT had sold for $69.3 million, while Kate Moss had sold a GIF of herself for more than $17,000.

One of the most popular NFT collections was (and still is) the Bored Ape Yacht Club. This collection boasts many celebrity collectors, such as Eminem, who owns an NFT called ‘EminApe’. He reportedly paid $450,000 for it. Other celebrity ‘Bored Ape’ collectors include Gwyneth Paltrow, Shaquille O’Neal, Neymar, Snoop Dogg, Mark Cuban, Post Malone, Steph Curry and Serena Williams.

Throughout 2021, Bored Ape NFTs became so popular that they were regularly being talked about on television. Over in America, in January 2022, Jimmy Fallon and Paris Hilton had one remarkable (and cringe-inducing) conversation about Bored Ape NFTs on The Tonight Show With Jimmy Fallon that immediately went viral… for all the wrong reasons.

https://www.youtube.com/watch?v=5zi12wrh5So (skip to 3.42)

The NFT Collapse

For many, the conversation between Fallon and Hilton highlighted all of the problems with NFTs – the two didn’t seem to understand the technology at all, and made NFTs look like a fad rather than a technology of the future.

Throughout their conversation, the two struggled to discuss the merit of their NFTs, settling on simply describing the appearance of the apes to the audience. Watch closely and you can pinpoint exactly when the ‘applause’ sign flashes in the studio.

For the majority, this discussion perfectly embodied the wide gulf between so-called NFT believers and those who believe NFTs are either a scam, a pyramid scheme or a complete waste of time.

Around a similar time, scepticism also grew further as NFT scams became more prominent. For example, in the same month, NFTs were described as a ‘huge mess of theft and fraud’ by one Dutch artist, who found more than 100 pieces of her art for sale. None of them had been put up for sale by her.

Added to this, while some investors were making money from NFTs, including a handful who were making huge sums, the majority of late entrants to the market were losing money.

As a result, in the first half of 2022, NFTs quickly declined in both popularity and value. One particular example shows just how sharp the decline in value of NFTs had been during this period. Remember the Jack Doresy NFT that sold for $2.9 million in March 2021? It was put up for auction in April 2022 with a listing price of $48 million – the top bid was just $280!

Throughout the rest of the year, more bad news stories emerged. For example, in August 2022, it was alleged that more than $100m worth of NFTs had been stolen since July 2021. On top of this, around this time, a crypto crash led to NFT sales hitting a 12-month low. The bubble had well and truly burst.

The NFT landscape in 2023

In September this year, a new report by dappGambl revealed that 69,795 out of 73,257 NFT collections now have a market cap of O Ether. In simple terms, this means that 95% of those holding NFT collections – or 23 million people – are holding worthless investments. The report also revealed that 79% of all NFT collections have remained unsold, as there is not enough demand to keep up with the supply.

On an individual level, Bored Ape Yacht Club NFTs were worth a minimum of $429,000 in April 2022, but by July 2023 they’d fallen in value by 88%.

NFTs: A marketing perspective

Price history can tell us a lot about NFTs as an investment between 2021 and 2023, but what about consumer interest?

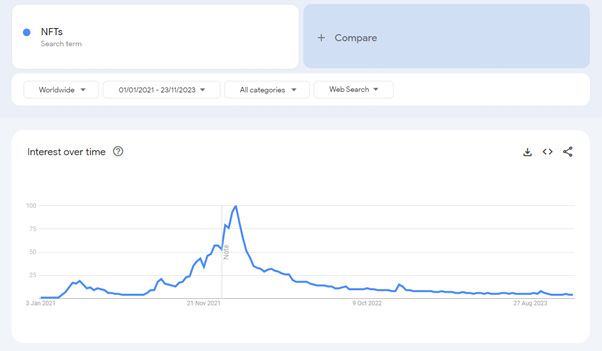

Well, search trends data tells its own story:

As this Google Trends graph shows, NFTs soared in popularity in late 2021. This was undoubtedly fueled by the constant news cycle, as well as celebrity endorsements and reports of huge financial gains.

However, in early 2022, we can see that search interest drops remarkably quickly. Now, in late 2023, search queries for ‘NFTs’ are almost non-existent.

So, from a marketing perspective, it’s clear that it’s not just that people don’t want to buy or invest in NFTs, it’s also that members of the public have completely lost all interest in discussing them and learning more about them. For this reason, we can now safely say that rather than being a technology of the future, NFTs are now viewed by most people as a complete fad.

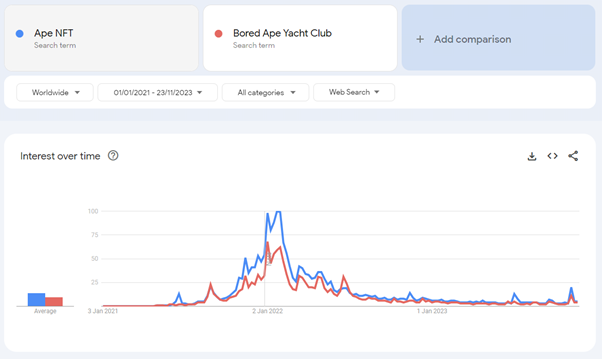

We also see a very similar story when we look at the Bored Ape Yacht Club collection:

As this Google Trends graph shows, search interest in the terms ‘Ape NFT’ and ‘Bored Ape Yacht Club’ follow a similar trend to search interest for ‘NFT’. Interest particularly peaks around the time of the Fallon and Hilton interview, before again falling sharply as the public loses interest.

Interestingly though, there was a small increase in searches for both terms earlier this month. But, this is due to reports that investors suffered from ‘eye burn, extreme pain and impaired vision after attending one of [the company’s] events, which was lit by UV lights’.

Why is this important?

As marketers, we’re all looking to capitalise on the latest trends. Whether we’re searching for the next viral TikTok trend, embedding AI into our workflows to cut down on admin, trialling native ads or embracing virtual reality and augmented reality as potential marketing methods, we want to be at the forefront of revolution. Ultimately, this is the way we can make the biggest impact for our clients.

However, this tale about NFTs is a cautionary one. After all, although trends like AI are undoubtedly here to stay, others like NFTs can quickly fade into the rearview mirror. Of course, this doesn’t just apply to NFTs: remember when everyone was using BeReal? As a result, as marketers, it’s vital that we’re able to differentiate between trends and fads.

Yes, keeping our thumbs on the pulse is important, and we should always be open to change. Otherwise, our businesses will fall behind. But, we must be sceptical about how long each trend will last and how much budget we should put into each trend or fad. Long-term planning in this regard can be foolish, we need to be agile and respond to what the data is telling us.

After all, NFTs have fallen off a cliff in just one year. Similarly, BeReal use has declined just as sharply – the app was downloaded 53 million times in October 2022, but now the number of people who use the app daily has dropped 61 percent from its peak.

In marketing, capitalising on fads is just as important as jumping on the latest trends. However, we need to spot the ‘sweet spot’. Invest too much marketing budget into a fad for too long and you’ll soon see drastically reduced ROI – just ask Sina Estavi about his Jack Doresy NFT.